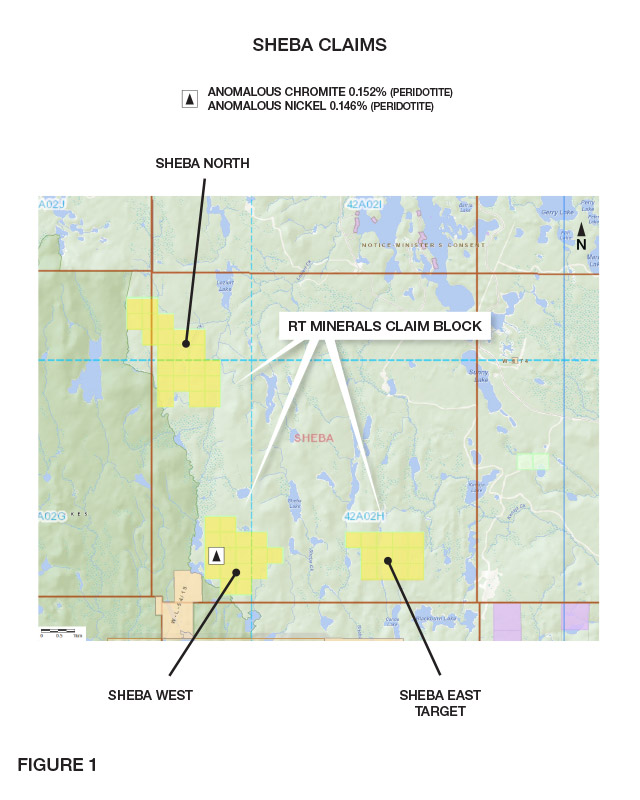

Vancouver, B.C. – June 13, 2023 – RT Minerals Corp. (TSXV: RTM) (OTC Pink: RTMFF) (the “Company” or “RTM”) announces that it has entered into an agreement (the “Agreement”) to acquire a 100% interest in 51 mineral claims (the “Property”) in Sheba Township in the Abitibi Greenstone belt, located within the Superior Province, 70 km southeast of Timmins, Ontario (Figure 1) for consideration of $3,000 and 250,000 common shares of the Company. The Agreement is subject to the acceptance of the TSX Venture Exchange (the “TSXV”).

The Property is divided into three blocks: Sheba North (23 claims), Sheba South (15 claims) and Sheba East (13 claims). The blocks are prospective for copper (Cu), nickel (Ni), cobalt (Co), chromium (Cr), platinum (Pt), and palladium (Pd) mineralization (MNDM files 42A02SE2019).

Previous exploration activities by other operators on the west border of the Sheba South block encountered samples taken from outcrop containing 0.19% Cu, 0.14% Ni and 0.34% Cr. In addition to these samples, further samples were historically taken within the same ultramafic Pyroxenite-peridotite assemblages on the Sheba South block which returned highly anomalous Cu, Ni and Cr values from outcrop. Whole rock analysis of these units appears substantially identical to the peridotites and associated Ni mineralization that occurs in Langmuir Township, 36 km on trend to the northwest.

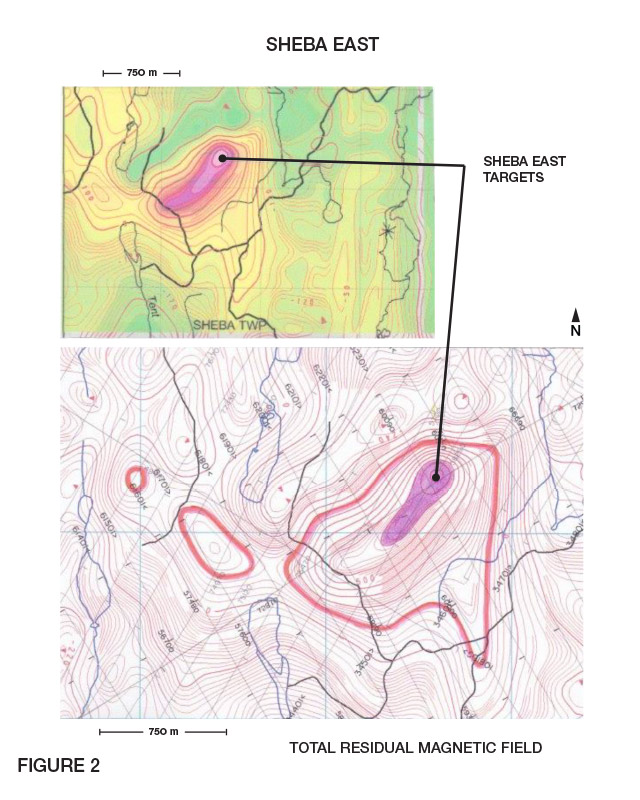

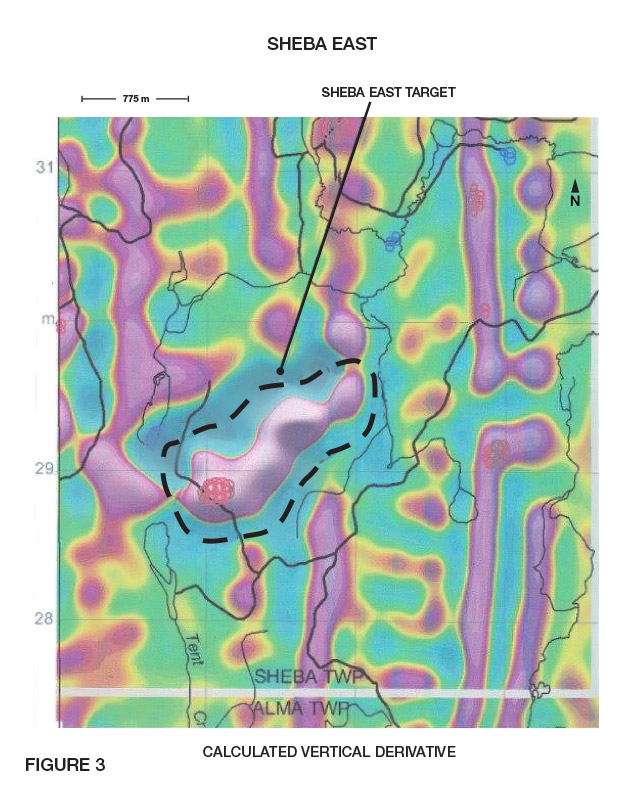

The pyroxenites-peridotites exhibit strong magnetic signatures and the Sheba North and Sheba East blocks cover extensive geophysical magnetic anomalies that are currently interpreted as peridotite intrusive bodies within the volcanic stratigraphy of the Abitibi Greenstone belt. The Sheba East anomaly is shown in Figures 2 and 3 (MNDM files M82050, M82049, M82031, M82032 and M82056).

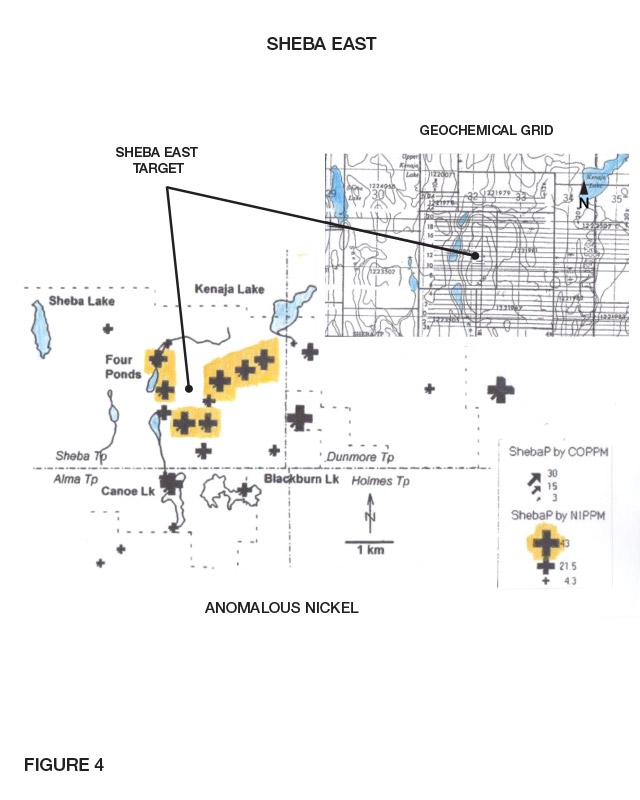

In addition, geochemical soil surveys indicate that the Sheba East block is covered by widespread anomalous Cu and Ni concentrations in soils (MNDM files 42 A02NE2002) (Figure 4).

The exploration programs contemplated on the three blocks are potentially eligible under the Federal Government of Canada’s flow-through shares and Critical Minerals exploration tax credit programs. The acquisition of the Sheba property expands the Company’s portfolio of 100% owned critical mineral and gold exploration projects to 13. Work permitting programs have been submitted on 7 of the properties for the 2023 and 2024 exploration years.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Mr. Garry Clark, P.Geo., a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Proposed Private Placement

The Company proposes to undertake a non-brokered private placement (the “Offering”) to raise gross proceeds of $100,000 through the sale of 1,000,000 units (each, a “Unit”) of the Company at a price of $0.10 per Unit. Each Unit consists of one common share and one-half of a share purchase warrant, with each whole warrant exercisable into one further common share at a price of $0.12 for a term of 12 months. The warrants will be transferrable, and all securities issued will be subject to a statutory hold period of four months and one day.

The proceeds from the Offering will be used for general working capital. The Offering is subject to the approval of the TSXV.

A director of the Company will acquire securities under the Offering, which will be considered a “related party transaction” as defined under Multilateral Instrument 61-101 (“MI 61-101”). Such participation is expected to be exempt from the formal valuation and minority shareholder approval requirements of MI 61-101.

RTM Engages Caram Media Inc.

The Company has retained the services of Caram Media Inc. (“Caram”) to perform advertising and marketing activities for the Company. Caram provides targeted investor outreach to increase investor awareness of its clients through retail targeted content distribution, institutional outreach and email campaign services. Caram is owned by Mr. Gaelen R. Carson, founder and CEO and the services will be provided by Mr. Carson. As compensation, the Company has agreed to pay Caram $22,500 for a 90 day term. The agreement is subject to the acceptance of the TSXV.

Mr. Carson states: “We are very pleased to have our marketing services engaged by RT Minerals Corp. The main Rare Earth Elements and Critical Minerals are an integral part of the electrification and technological advances of today’s society, and we believe RT Minerals is strategically positioned to capitalize on this long runway of growth. Caram’s innovative media strategies, advanced technologies, and creative solutions will be leveraged to amplify RT Minerals’ message, enhance their brand presence, and generate exposure, in a cost-effective manner. We are excited to contribute to RT Minerals’ initiatives on this transformative journey.”

About RT Minerals Corp.

RT Minerals Corp. is a junior exploration company listed on the TSX Venture Exchange under the symbol “RTM”. The Company holds a 100% interest, largely royalty-free, in a portfolio of rare earth element, gold and base metal properties in Ontario. The Company also holds an option to acquire a 100% interest in the Link-Catharine RLDZ gold property located 22 km south-southeast of the town of Kirkland Lake, Ontario.

Ireland Property (Rare Earth Element – Case Batholith) is a royalty free 52 claim block covering an inferred carbonatite complex (the “Ireland Complex”) located in Ireland Township, 45 km northeast of Smooth Rock Falls, Ontario. The Ireland Complex is 100% owned by RTM and is approximately 4.0 km long, 2.8 km wide, oval shaped and is positioned along a southern extensional splay fault contained within the Kapuskasing Structural Trend. The Kapuskasing Structural Trend contains several well documented carbonatite complexes that contain Niobium, Iron, Titanium and Rare Earth Element resources within various assemblages of carbonatite rocks.

Case Batholith Group 1 (Rare Earth Element) consists of 90 claims covering the Case Batholith centered on Heighington Township, 85 km northeast of Cochrane, Ontario. The Case Batholith properties are 100% owned and royalty free. The properties occur within the boundaries of the Case Batholith and are specifically located in Heighington, Kenning, Sequin, and Case Townships. Five properties are situated 12 km north of the Power Metals Case Lake lithium/cesium discovery in Steel Township.

Case Batholith Group 2 (Rare Earth Element) consists of four properties (113 claim blocks) that are 100% owned and certain of the claims are subject to a 2% NSR royalty, within the boundaries of the Case Batholith in northern Ontario. The four properties are located in Agassiz township (29 claims), Potter township (51 claims), Seguin/Challies township (14 claims) and Bragg township (19 claims). The properties are located to the northwest of Power Metals Corp. Case Lake lithium/cesium discovery in Steel township, Ontario. All of the claim blocks have been acquired on the basis of magnetic signatures resembling east – west trending pegmatitic dykes and laccolith structures contained within the tonalite/granodiorite rock assemblages of the Case Batholith.

Kendrey Property (Rare Earth Element) consists of 32 claims in the Kendrey and Colquhoun Townships located 14 km southeast of Smooth Rock Falls, Ontario that are 100% owned and royalty free. The property covers what appears to be a large, inferred carbonatite complex that is prospective for rare earth elements, specifically niobium. The intrusive is approximately 2.8 km wide and 2.7 km long. It is positioned along a southeastern extensional splay fault belonging to the Kapuskasing Structural Trend.

Kenogaming, Pharand I and Pharand II Properties (Nickel, Chromium, Cobalt) consists of 38 claim blocks that are 100% owned and certain of the claims are subject to a 2% NSR royalty.

Nordica Property (Cu, Ni, Co, Cr, Pd) consists of 34 claims in Nordica Township that cover the ultramafic layered Nordica Intrusive Complex in the Abitibi Greenstone Belt. The Company acquired 100% interest in 14 of the claims through map staking and 20 of the claims are under a purchase and sale agreement pending acceptance by the TSXV.

Galna / Moody Property (Cu, Ni, Co, Cr) consists of four separate claim blocks totalling 24 cells in the Galna and Moody Townships, located 35 km east of Iroquois Falls, Ontario. The Company acquired 100% interest in the property by map staking.

Sheba (Cu, Ni, Co, Cr, Pt) consists of 54 claims in Sheba Township in the Abitibi Greenstone belt, located within the Superior Province, 70 km southeast of Timmins, Ontario.

Timmins Property (Base Metals) is a royalty free 16-claim block located approximately 50 km southeast of Timmins, Ontario, and is 100% owned by RTM. The property features several mineralized fault systems that suggest proximity to a base metal source.

Link-Catharine RLDZ Property (Gold) is comprised of fifteen unpatented single cell mining claims with a total area of 220 hectares in one claim block. The Link-Catharine property is located 22 km south-southeast of the town of Kirkland Lake, Ontario. RTM has an option to earn a 100% interest in this property subject to a 2% NSR.

Milligan Property (Gold) is a royalty free 16-claim block located approximately 75 km northeast of Timmins, Ontario, and is 100% owned by RTM. The Milligan property covers the southeast extension of the volcanic stratigraphy hosting the Eastford Lake gold discovery of 142.2 g/t Au over 3.0 m announced by Explor Resources in 2009.

Blakelock Property (Gold) is a royalty free 9-claim block located approximately 75 km northeast of Cochrane, Ontario, and is 100% owned by RTM. The property is host to a massive east-west trending magnetic high intrusive complex that was subject to limited drilling in 1967.

Mcquibban Property (Gold) is a royalty free 19-claim block located approximately 50 km north of Cochrane, Ontario, and is 100% owned by RTM. The property hosts a strong 3.0 km long east-west trending inferred oxide facies banded iron formation, in which one historical drill hole encountered a gold mineralized interval of 5.47 g/t Au over 1.2m.

For more information on the Company and its properties, please visit the Company’s website at www.rtmcorp.com.

FOR FURTHER INFORMATION CONTACT:

Douglas J. Andrews, B.Sc., M.Sc. President and Chief Executive Officer, RT Minerals Corp.